utah tax commission payment

LISTING OF ALL TAXES FEES. Most taxes can be paid electronically.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content.

. Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext.

INDIVIDUAL INCOME TAXES BUSINESS CORPORATE TAXES SALES USE TAXES WITHHOLDING TAXES FUEL TAXES CIGARETTE TOBACCO TAXES MOTOR VEHICLE TAXES FEES PROPERTY TAXES TAX INSTRUCTION TRAINING JOB OPENINGS APPLY NOW. You can also pay online and avoid the hassles of mailing in a check. Filing Paying Your Taxes Payment Options Penalties and Interest Extensions and Prepayment Income Tax Estimator Tax Rates Payment Agreement Request Utah Use Tax This section discusses information regarding paying your Utah income.

What you need to pay online. Write your daytime phone number and 2021 TC-40 on your check. Has your tax bill crept up on you unexpectedly.

In Utah residents are expected to pay anywhere from 6 to 905 in sales tax. Utahs Tax Portal File pay manage your Utah taxes online. Follow the instructions at taputahgov.

Utah Tax Payment Plan. The Utah State Tax Commission is the primary tax collecting agency for the state of Utah. If you create more debt your pay plan will default.

We will send you a bill if you do not pay the penalties and interest with your return or if the penalty. You have been successfully. You must file all required tax returns and pay them in full on or before their due date.

Remove any check stub before sending. 7703 The Utah State Tax Commission accepts Visa MasterCard Discover Card and American Express credit cards. Make your check or money order payable to the Utah State Tax Commission.

Go to taputahgov and choose Request Waiver Payment Plan E-Reminder You may also call the Tax Commission at 801-297-7703 or 1-800-662- 4335 ext. Ad No Money To Pay IRS Back Tax. Utah Taxpayer Access Point TAP TAP.

Rememberyou can file early then pay any amount you owe by this years due date. Please contact us at 801-297-7780 or dmvutahgov for more information. A payment agreement plan cannot be set up until after the return due date and when weve processed your return.

The official site of the Division of Motor Vehicles DMV for the State of Utah. If you cannot pay the full amount you owe you can request a payment plan. Filing Paying Filing Paying Your Taxes This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

When it comes to personal income taxes Utah residents will pay a flat rate of 495. Make sure you put your name and account number on your payment. See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. Use the Online Penalty and Interest Calculator to calculate your penalty and interest or follow the instructions in Pub 58 Utah Interest and Penalties. Ad Pay Your Utah Dept of Revenue Bill Online with doxo.

Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with your return. INSTRUCTIONS LINE-BY-LINE INFO FILING PAYING YOUR TAXES TOPICS CREDITS ADDITIONS ETC. Mail your payment to 210 North 1950 West Salt Lake City UT 84134-7000.

To pay Real Property Taxes. Businesses can file and pay their taxes online by mail or in person. Online payments may include a service fee.

The Utah State Tax Commission can be reached at 801 297-2200. A convenience fee is charged for payments by credit card. Billing Payments This section will help you understand tax billings and various payment options.

Do not staple your check to your return. REFUND METHODS INFORMATION FORMS PUBLICATIONS OFFICES ADDRESSES CONTACTS DUE DATES EXTENSIONS PREPAYMENTS USE TAX INFO ONLINE SHOPPING FREE TAX RETURN ASSISTANCE. While Utah residents pay a low property tax rate they make up for it in sales taxes.

They are responsible for administering and enforcing the states tax laws including sales and use taxes.

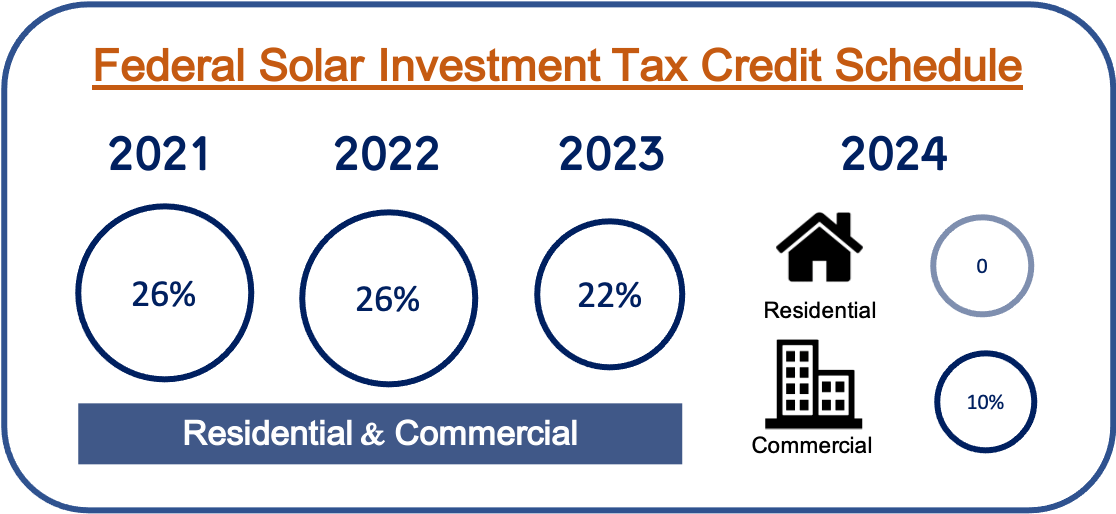

Solar Incentives In Utah Utah Energy Hub

Utah State Tax Commission Notice Of Change Sample 1

![]()

Utah Income Taxes Utah State Tax Commission

Utah Sales Tax Small Business Guide Truic

Utah State Tax Commission Notice Of Change Sample 1

11 State Tax Tokens Missouri Utah Illinois Washington

Utah State Tax Commission Official Website

Utah Ends Tax On Military Retirement Pay Hill Air Force Base Article Display

Free Bill Of Sale Utah State Tax Commission Doc 38kb 1 Page S